Starting register online tax payment 24/7

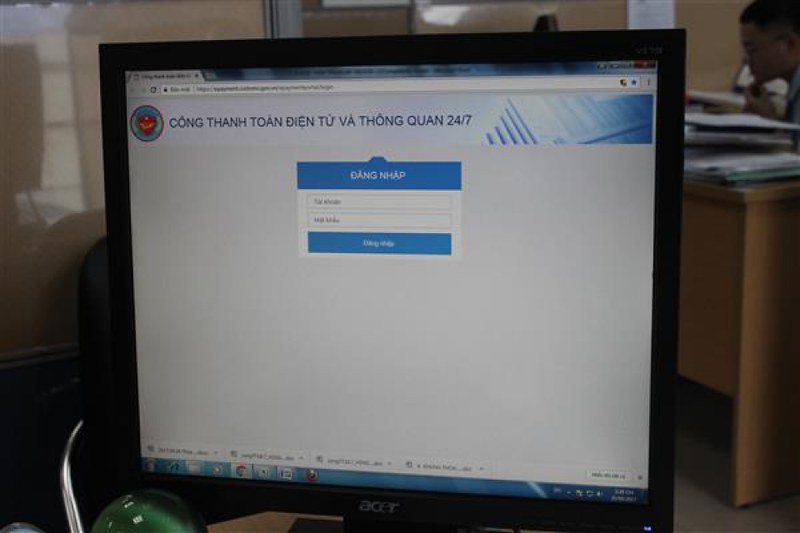

VCN – From 26/9/2017, the General Department of Vietnam Customs will receive the registration, updating relevant information for taxpayers when registering to participate in electronic tax payment 24/7 at the website of the General Department of Vietnam Customs (address: https://epayment.customs.gov.vn/epaymentportal/login)

To participate in this new tax payment process, taxpayers have to register by using digital signatures that used for declaring Customs procedures for paying taxes and updating information on authorized debit bank account when using 24/7 tax payment and clearance; register email, phone number of the taxpayer.

Taxpayers declare customs procedures on the electronic customs clearance system of the Customs authority. After completely declaring, the system will automatically determine the amount of payment for each tax types, account, code and name of Customs office, code, and the name of the treasury where the declaration is made.

The General Department of Vietnam Customs requests provincial customs to inform and instruct the enterprises to register and update related information into the system; contact to the bank where opened business account to carry out authorized debit procedure, prepare to pay electronic taxes 24/7.

“Online tax payment 24/7” is a new tax channel that the General Department of Vietnam Customs opened in parallel with the current tax regime, “online tax payment 24/7” allows taxpayers to establish tax payment list directly on the e-customs payment gateway so that enterprises can actively pay taxes wherever they have internet at anytime, anywhere.

Furthermore, “Online tax payment 24/7” will limit the inadequacies that current tax collection has not made and to meet the requirements of administrative reform.

Moreover, maximizing to facilitate to taxpayers, minimizing payment in cash; ensuring payment information is liquidated tax timely and accurately; reducing time of tax payment as the same time processing cargo clearance in time after paying tax, thus shortening time for completing import-export goods customs procedure of the enterprise that is downed to average level of ASEAN-4 group.

Source: customsnews.vn