Foreign Direct Investments and Dispute Resolution

IMF, or the International Monetary Fund, has defined Foreign Direct Investment (FDI) as a cross-border investment. This simply means that a resident of one area will have control or strong influence in the management of a business enterprise resident in another area. FDI will happen due to the linking and globalization between different economies.

Increased FDI in Various SEA Nations

When it comes to international investments, there seems to be an investment growth in Asia. Even though there is the threat of the Asian Financial Crisis (AFC), the investment flow from FDI doesn’t seem to be affected at all. While exports only make up ¼ of the FDI, sales to any foreign clients make up ¾ of the FDI. South East Asian countries tend to attract a lot of investments from the U.S.A., Japan, Canada and various European countries. The larger economies in Asia tend to have direct investments with smaller economies in the South East Asian areas.

Inflow of FDI to Vietnam

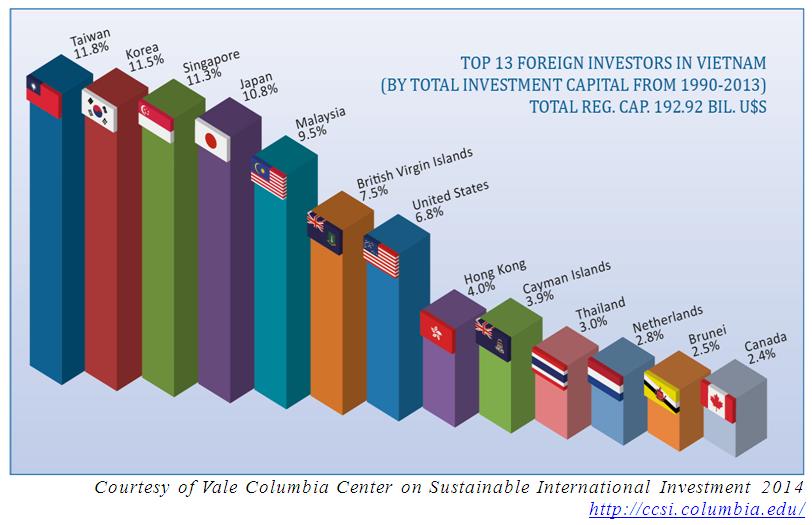

What many people do not know is that Vietnam attracts investments upwards of tens of millions in USD from countries like South Korea, Taiwan, Japan, Malaysia, Singapore and others. According to the World Investment Report 2013 by UNCTD, Vietnam, Indonesia, and Thailand are listed in the top 10 prospective host countries that attract FDI. Due to the rising production costs and wages in India and China, other South East Asian countries tend to enjoy and get all the attention from most foreign investors.

Taiwan happens to be number one on the list for foreign investors in Vietnam in the last 30 years at 11.8% while Korea comes in second at 11.5% and Singapore is third at 11.3%. Malaysia and Japan account for 1/10 of Vietnam’s annual FDI. The United States of America (6.8%), Hong Kong (4.0%), and the British Virgin Islands (7.5%) make up 4-8 % of Vietnam’s entire FDI each.

Vietnam Sector FDI Inflow

The Manufacturing sector in Vietnam accounts for 60% of foreign direct investments, while the crude oil fields accounts for more than 20% of the investments from foreign investors. Heavy industries FDI is 20% of all foreign investments and real estate housing has been at a steady 18% for a sustained period of time. Although financing and banking industries have done well, they have contributed to 1/5 of the investments from foreign countries. Surprisingly, the education sector has done very poorly; they account for less than 1% of Vietnam’s entire FDI. The most insignificant contributions to the FDI come from agriculture, health care, light industries, tourism, and fisheries. City and urban development, as well as other contributors in the real estate businesses, make up 1/10 of the annual FDI in Vietnam.

When it comes to monetary figures, the processing and manufacturing sections bring in an investment capital of $120 billion USD while the real estate section comes in at $48 billion USD and hotels bring in $10 billion USD. Agriculture & fishery, wholesale & retail, arts & entertainment, and transportation & warehousing brings in a $3 million USD each, equaling an annual $21 million USD. The gas and construction sectors make an annual $9 million USD each when it comes to foreign direct investments.

Dispute Resolutions that Involve Foreign Direct Investments

When it comes to foreign banking or investments, there are numerous disputes that can arise. The multiple parties that can be involved in disputes normally need high levels of mediation to settle them. Laws that relate to different areas tend to be different, and make it impossible to resolve the disputes using local legislation. Business operations will have various challenges when it comes to cases of foreign investments.

The Role of Local Jurisdictions

It is sad to say, but local jurisdictions can be unreliable and lacking when it comes to any foreign investors. Local jurisdictions will often support the local community, as the legal set-up states. A truly independent dispute resolution is extremely rare. Local courts in Asian communities do require the use of the region’s language for any proceedings in a dispute, which can be problematic. Countries are trying to work towards building dispute resolution implements of very high standards. When economies work on providing maximum efficiency and transparency for their foreign investors, then there will be an increase of FDI inflow. Local parties will often counter any legal claims made against them in order to harass the foreign investors.

Dispute Resolutions in Vietnam

Any court proceedings that happen in Vietnam require the use of Vietnamese in written and verbal communication. Foreign applications of law and languages are only allowed in arbitration cases. Normally, dispute settlements can take up to two years in Vietnamese local courts. Foreign law can be used in resolution cases held in Vietnam’s local courts, unless they are identical working laws. The resolution can be applied if the judgment is within the local principles of the local laws, and a foreign court’s judgment can be applied as well in special cases. Foreign arbitral awards and judgments can be used in Vietnamese courts in special cases.

The Vice Minister of Justice, Nguyen Duc Chinh, and 18 other ministry officials issued a decree in January 2013 to require the use of mediation in legal proceedings. It has been statistically proven that alternative dispute resolution processes such as mediation can cut costs by up to 57% to the parties of the dispute. Parties who used the Mandatory Mediation Program in Canada to settle commercial disputes noticed that there was only a 2% negative impact when using mediation. The majority of the cases that involved mediation were usually settled within just 8 days through the Canadian Mandatory Mediation Program.

International Dispute Settlements in Vietnam

Legal uncertainties can arise when it comes to foreign investments, so it is hard to have stabilized international laws that relate to dispute settlements. Investment treaties are usually forced on various economies, which want to be a part of a globalized economy. Several international dispute resolution parties have introduced transformation of investment treaties and laws. So, alternative dispute resolutions have been created to meet the updated economical setup. This is where arbitration and mediation come into play. They are proven tools that will help to solve many international disputes. Not only is mediation a more cost-effective way to resolve legal disputes, having mediation in Vietnam would benefit all parties involved by creating a win-win situation for the litigants. They will find a common solution instead of having and keeping adversarial positions during international disputes. There are specialized institutions, such as the International Centre for Settlement of Investment Disputes (ICSID) as well as Vietnam International Arbitration Center, which work with dispute resolutions and try to encourage the global flow of foreign investments.

Prevention of Abuse in Dispute Resolution

Prevention of abuse when it comes to foreign investors is something that should be looked at. Any foreign investor should be encouraged to seek the proper legal resolution before the tribunal in South East Asian countries, rather than to look into the local jurisdictions. If the local laws attempt to settle disputes rather govern the parties, then the appropriate tribunal must be able to give a judgment in the host country to apply the agreed foreign laws. This could be a huge confidence booster for foreign investors as well as allow them to investigate abuse from the local parties.