Ministry of Finance proposes to raise VAT to 11% from 2019

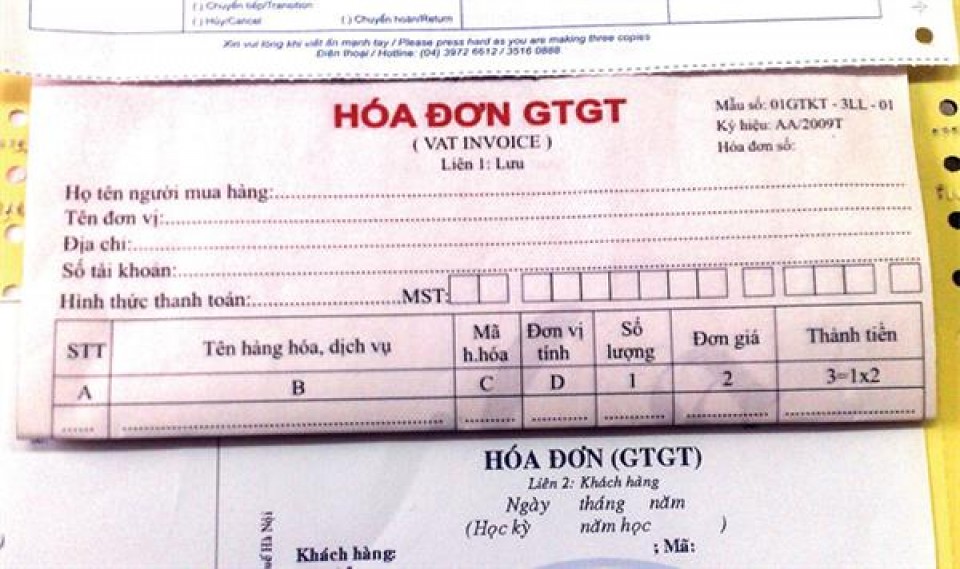

VCN – In the draft report to the Government on the proposal to develop a Law amending and supplementing some articles of the latest Law on Value Added Tax, the Ministry of Finance continues to propose to raise the value added tax to 11% instead of the current 10%.

According to the Ministry, in the context of where public debt has risen too much in countries, including developed countries, governments tend to restructure state budget revenues in the direction of increasing revenues from indirect taxes.

Specifically, in order to increase revenues to compensate for lower revenues due to lower income taxes (corporate income and personal income), countries are turning to raise consumption tax (value added tax and special consumption tax). The number of countries applying value added tax / tax on goods and services has been increasing, from around 140 in 2004 to 160 in 2014 and 166 in 2016.

The Ministry of Finance also explained that along with the increase in the number of countries applying value added tax to regulate consumption as well as to increase the budget revenue, the tendency of increasing the VAT rate has also become popular. According to statistics, from 2009 to 2016, countries increased the common tax rate, for example: the average tax rate in EU countries in 2000 was 19%, in 2014 was approximately 21.5%, and countries in the Organization for Economic Co-operation and Development (OECD) also tended to increase their VAT rates from an average of 18% in 2000 to around 19% in 2014 and more than 19% in 2016. Asian countries also tended to restructure state budget revenues in the direction of increasing the proportion of consumption tax in total state revenue from an increase in VAT rate, such as the Philippines, India and Japan.

According to the World Bank, the statistic of the tax rate of 112 countries showed that, 88 countries have tax rates from 12% to 25% (of which 56 countries have tax rates from 17% to 25%), the remaining 24 countries have tax rates at more than 10%. Some countries in the region have lower VAT rates than Vietnam, but the revenue proportion from consumption taxes, including VAT, of total state budget revenue is higher. Specifically, the revenue proportion of Vietnam’s goods and services taxes in 2016 accounted for 47.5% of total state budget revenue, lower than that of Thailand (53.9%), Laos (55.9%), Cambodia (55.5%), and the Philippines (45.6%).

Therefore, the Ministry of Finance proposed to increase the VAT rate according to a roadmap as follows: From 1st January 2019, VAT rate shall increase from 10% to 11%; from 1st January 2020, the rate shall increase from 11% to 12%.

Nguồn: customsnews.vn