Vietnam boasts of friendly laws for foreign investment allowing the foreign investors to investment in all the legally permitted business lines. The human resource in Vietnam is growing progressively with the skilled and trained youth graduating every year. At the same time Vietnam, with low labor cost and general business costs added with attractive financial incentives, stands out to be one of the lowest cost manufacturing hub for the foreign companies. There are certain business sectors which are conditional business lines for the foreign investors viz. broadcasting, transport activities ports/airports, real estate, mining, aquaculture, education and training, tobacco, hospitals and clinics and post and telecommunications.

What kind of investment should the foreign investor make?

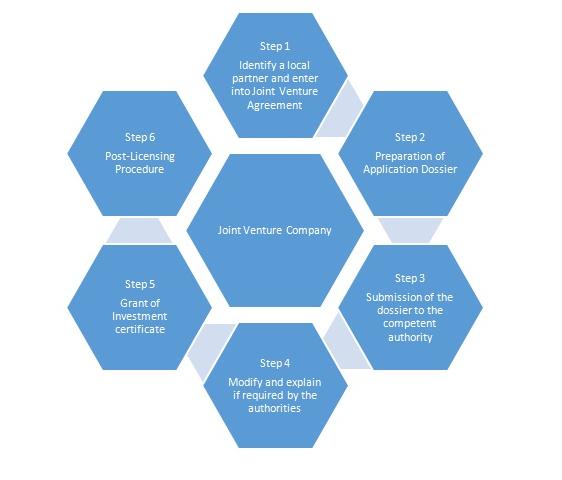

The roadmap of incorporation of a company with foreign investment will start with what type of investment to be made by the foreign investor, whether in the form of a joint venture company or 100% foreign investment, either as a limited liability company or joint stock company. The Joint Venture Company is preferred as a Vietnamese local partner shall have key assets, local know-how and knowledge and also the land use rights. Though after incorporation of the company, there is no difference between a Wholly Foreign Invested Company and a Joint Venture Company before the laws, the Licensing Authority shall be more vigilant towards application dossiers applying for Wholly Foreign Invested Company than Joint Venture Company.

What do you need to start a Company?

The foreign investor is required to obtain Investment Certificate to incorporate a Company. prepare and submit an Investment Project exhibiting the expenditure of medium and long-term capital to carry on investment activity for a specific duration. The investor should identify the location of the company. Though the law does not specify required minimum investment capital for incorporating a company in Vietnam except for the conditional business lines, it is advisable that the investor exhibits adequate or sufficient capital resources to successfully realize the business goals in Vietnam.

Who will process my application?

The application dossier for Investment Certificate shall be submitted to the competent approval authority which may vary from the Prime Minister, Ministry of Planning and Investment, People Committee and the Management Board of Industrial Zones, depending upon the type and dimension of the project. Once the Investment Certificate is obtained, the Company should apply for the Seal of the Company and Tax Code Certificate of the Company.

What are the steps in incorporation of a Joint Venture Company?

Can I start my business once Investment Certificate is granted?

There are certain procedures to be complied with once Investment Certificate is obtained. Non-compliance of the following shall attract administrative penalties.

Will a foreign invested company allowed to remit back any profit?

Foreign invested company in Vietnam shall pay tax on all income arising in Vietnam and on foreign income that relates to the establishment. If there is no permanent establishment, then the taxable income is only the income arising in Vietnam. The foreign investors are also permitted to remit back abroad after discharging fully its financial obligations to Vietnam, viz.

- Profits derived from business activities

- Payments received from the provision of technology and services and from intellectual property

- Principal or any interest on foreign loans

- Invested capital and proceeds from the liquidation of investments; and

- Any other money and assets lawfully owned by the foreign investor.

How does the Government protect the foreign invested company?

The Vietnamese law ensures that the lawful assets and invested capital shall not be nationalized or confiscated by administrative measures. At any time if any new law is passed and if the company is entitled to any higher benefits and incentives from what they are receiving present, then the investor shall be entitled to the benefits and incentives in accordance with the new law. At the same time, if the new law adversely affects the lawful benefits enjoyed at that point of time by the foreign investor then the investor shall be guaranteed to enjoy the incentives the same as in the investment certificate.

Is the intellectual property rights protected?

Vietnamese law protects intellectual property rights during investment activities and the State ensures the legitimate rights of investors in technology transfer in Vietnam in accordance with the laws on intellectual property and other provisions of relevant laws.

Kavitha Kannan